In the complex landscape of higher education finance, the Chart of Accounts (COA) serves as the cornerstone for capturing, categorizing, and analyzing financial transactions. This accounting tool is not just a list of departments and accounts; it's a structured framework that enables institutions to manage their financial operations and reporting effectively. A well-designed COA structure is especially critical in large, research-intensive (R1/R2) universities where the scale and diversity of operations—from research grants to multiple campuses—demand a high level of financial granularity and control.

The COA's role extends beyond basic bookkeeping. It facilitates a wide range of financial management activities, including but not limited to, expense tracking, revenue recognition, asset management, and liabilities. Moreover, it plays a pivotal role in generating key financial statements, aiding in budgetary controls, and ensuring compliance with regulatory requirements.

In R1/R2 universities, the COA must be designed to accommodate a multitude of needs: it must be flexible enough to adapt to changing organizational structures yet robust enough to meet stringent reporting and compliance standards. It also needs to integrate and function seamlessly with advanced Enterprise Resource Planning (ERP) systems, like Oracle Cloud Student, which offers automation and real-time analytics.

The Chart of Accounts (COA) serves as the backbone of any financial system, providing a structured view of an organization's financial transactions. For higher education institutions, which often have diverse and complex operations, designing an effective COA structure is crucial. This white paper aims to delve into the various functionalities and considerations for designing an effective COA in higher education settings.

The Role of COA in Transactions, Reporting and Analysis

Before diving into the design considerations, it's essential to understand how COA is used in the day-to-day financial operations of an institution. The COA structure is not just a static framework but a dynamic tool that plays a critical role in capturing transactions, generating reports, and facilitating analysis. The following section shows some examples in each area.

Usage of COA in Capturing Transactions

Expense Tracking: In expense tracking, specific COA values are crucial for accurate allocation. When a department incurs an expense, it's recorded with designated COA values such as the department code, fund code, and project code. This ensures that the expense is correctly attributed, facilitating accurate budget management, financial reporting, and compliance, especially in complex settings of large universities.

Revenue Recognition: In revenue recognition, COA values play a vital role in categorizing different income streams like tuition fees or grants. Specific COA values, such as department code or fund code, are assigned to each revenue transaction. This ensures accurate tracking and allocation, making it easier for financial reporting and compliance, a critical aspect of any higher education institution.

Asset Management: In asset management, COA is essential for capturing purchases of long-term assets like buildings or equipment. Specific COA values, such as asset category or department code, are used to record these transactions. This enables accurate tracking and calculation of depreciation, aiding in both financial reporting and compliance.

Usage of COA in Reporting

Financial Statements: In generating financial statements, COA serves as the backbone for compiling key reports like the balance sheet and income statement. Specific COA values categorize transactions into appropriate accounts, such as assets, liabilities, or revenue streams. This enables accurate and comprehensive financial reporting, a critical function for transparency and decision-making.

Budget vs Actual Reports: In creating Budget vs Actual reports, COA is crucial for identifying discrepancies between planned budgets and actual spending. COA values, such as department or project codes, are used to categorize transactions. This allows for precise comparison between budgeted and actual figures, aiding in financial analysis and future planning.

Grants Reporting: In grants reporting, COA is essential for generating reports that meet grantor requirements. COA values, such as grant code or project code, are used to categorize grant-related transactions. This ensures accurate and compliant reporting, a critical aspect of maintaining funding and meeting regulatory obligations.

Departmental Reports: In the context of departmental reports, COA enables individual departments to generate tailored financial reports. By using specific COA values, such as department codes or activity codes, departments can isolate their own transactions for analysis. This facilitates better budget management and operational planning.

Usage of COA in Analysis

Trend Analysis: For trend analysis, COA is invaluable in identifying financial patterns, such as rising expenses in a specific department. By using particular COA values like department codes or expense categories, financial trends can be isolated and analyzed over time. This aids in proactive decision-making and strategic planning.

Cost Allocation: In cost allocation, COA is crucial for precise financial planning and analysis. Specific segment values, such as department codes or activity codes, are used to allocate costs accurately across various units or projects. This enhances financial accuracy and allows for more targeted budgeting and forecasting.

Performance Metrics: In measuring performance metrics, COA serves as a foundational tool for calculating Key Performance Indicators (KPIs). By utilizing specific COA values like revenue streams or expense categories, organizations can accurately gauge performance metrics such as profitability ratios or operational efficiencies. This is particularly valuable for data-driven decision-making in complex and large-scale institutions like R1 universities.

Scenario Planning: In scenario planning, COA is instrumental in conducting "what-if" analyses to predict the financial impact of various scenarios. By leveraging specific COA values, such as revenue categories or expense types, organizations can model different financial outcomes. This is crucial for risk assessment and strategic planning, especially in large and complex settings.

Design Considerations for COA

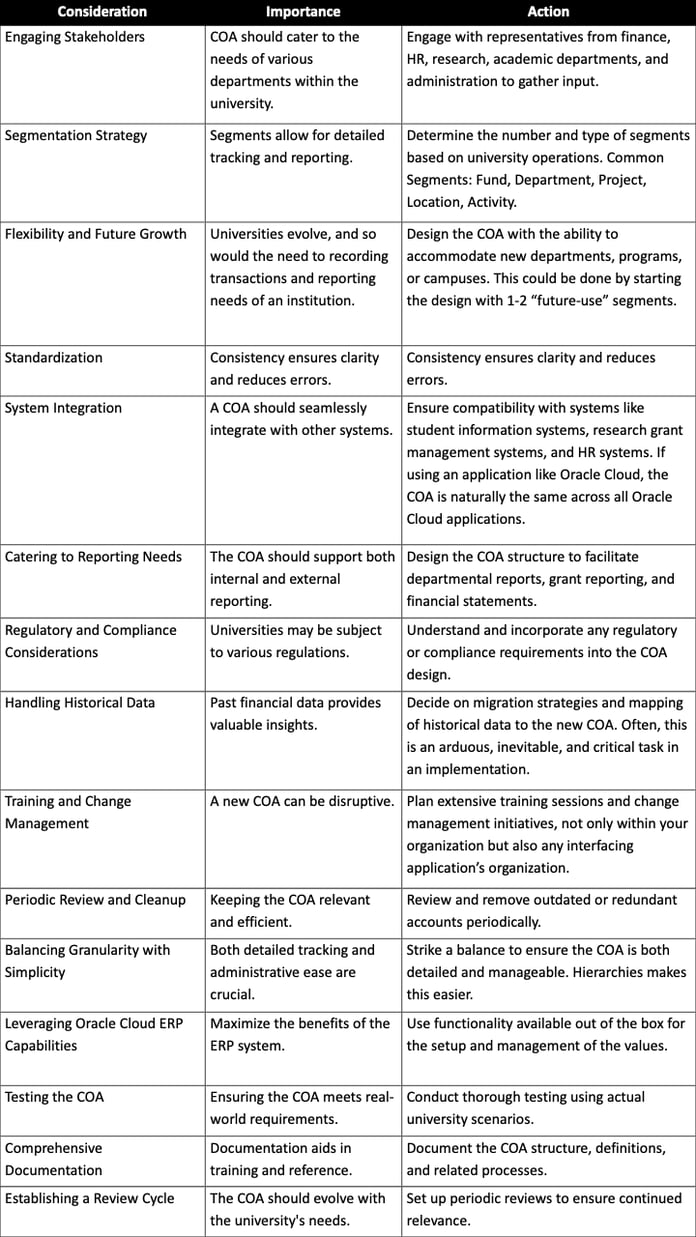

Embarking on the journey to design a Chart of Accounts (COA) structure for an institution is akin to laying the foundation for a complex architectural structure. Just as the foundation must support various elements of the building, from its weight to its functionality, the COA must be robust enough to support the intricate financial landscape of a multifaceted educational institution. This section delves into the critical considerations that must be considered to ensure that the COA structure is not only comprehensive but also flexible, standardized, and aligned with the university's strategic objectives.

Following are some critical considerations when designing an efficient COA structure:

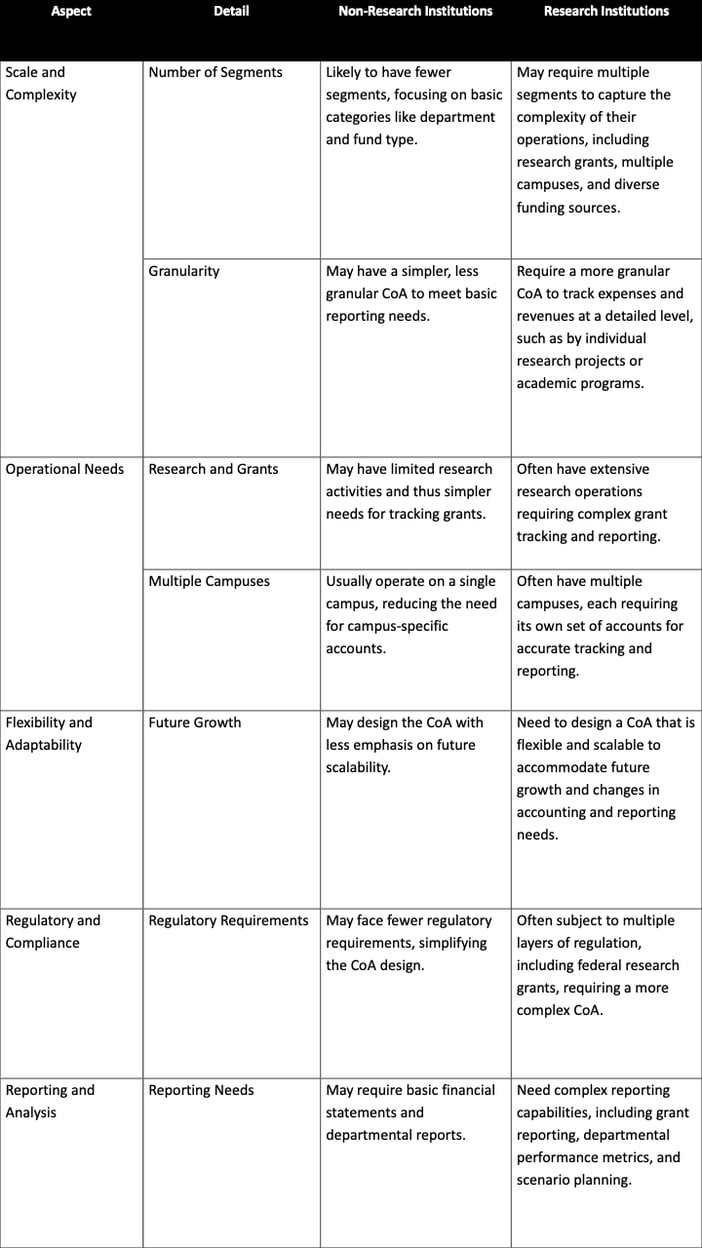

COA Design Differences between Research Institutions and Others

The design of a Chart of Accounts (CoA) can vary significantly between Research (R1/R2) institutions and other educational institutions due to differences in scale, complexity, and operational needs. Here are some key differences:

Understanding these differences is crucial when designing a CoA for either type of institution, as it will significantly impact the CoA's complexity, granularity, and overall structure.

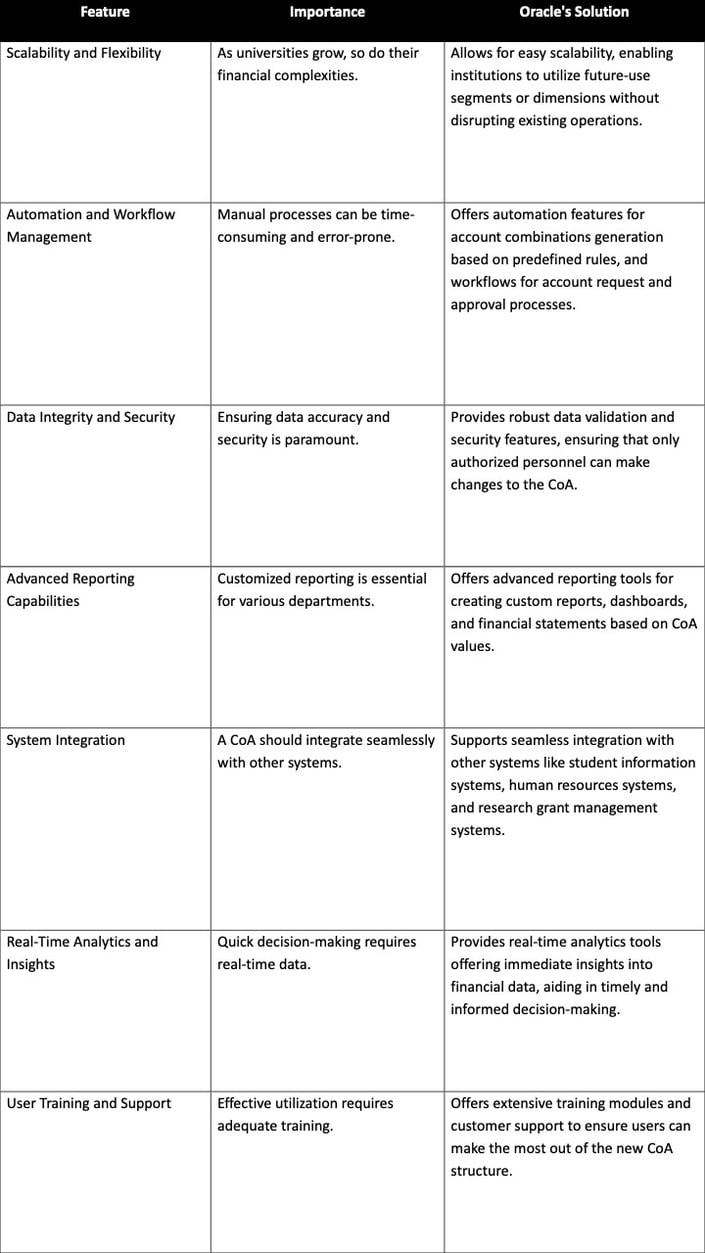

Leveraging Oracle ERP Cloud for an Efficient COA Design

Oracle ERP Cloud offers a suite of tools and features specifically designed to assist higher education institutions in creating an efficient and smart Chart of Accounts (CoA). Here's how Oracle ERP Cloud can make a difference:

By leveraging these features, higher education institutions can design a CoA structure and values that is not just a static framework but a dynamic tool that evolves with the institution's needs, thereby maximizing the utility of their Oracle ERP Cloud implementation.

Conclusion

The Chart of Accounts (CoA) is a critical asset for the financial management of higher education institutions. It serves multiple roles, from basic accounting tasks like expense tracking and revenue recognition to more strategic functions like compliance and scenario planning. In R1/R2 universities, the CoA must be both robust and flexible, capable of adapting to diverse funding sources, multiple campuses, and complex regulations.

Using advanced ERP systems, such as Oracle Cloud ERP, can further amplify the CoA's capabilities, offering real-time analytics and automation. The design and implementation of a CoA are not just operational tasks but strategic imperatives that require careful planning and stakeholder involvement.

By considering the above factors and leveraging the capabilities of Oracle ERP Cloud, institutions can design their CoA that not only meets their current needs but also adapts to future challenges.